Joe Biden’s tax plan and why hiking rates for the wealthy impacts us all

It happened again. News media reported on Joe Biden’s tax plan and the masses were quick to their conclusions. Of particular concern: the conclusion that the news wasn’t relevant to them.

“But this is for people who make over $400,000.”

And so they excuse themselves from the conversation, breathing sighs of relief because, so long as their individual tax rates are low, our government is fighting for the middle class.

I hear this and I die inside.

The fact that so many Americans believe these tax policies don’t affect them is evidence of a failure to teach the basics of taxation or economics to anyone who votes. It seems no one understands anything but memes or digs deeper than headlines; we need to do better.

Combined federal and state income tax rates that are reaching 62 percent in states like New York, New Jersey and California are beyond alarming — or at least they should be to more taxpayers than just the wealthy ones. There seems to be this satisfaction in “sticking it to the rich” in the form of taxes, and less of an understanding on how our economy works better when an appropriate amount of taxes are levied.

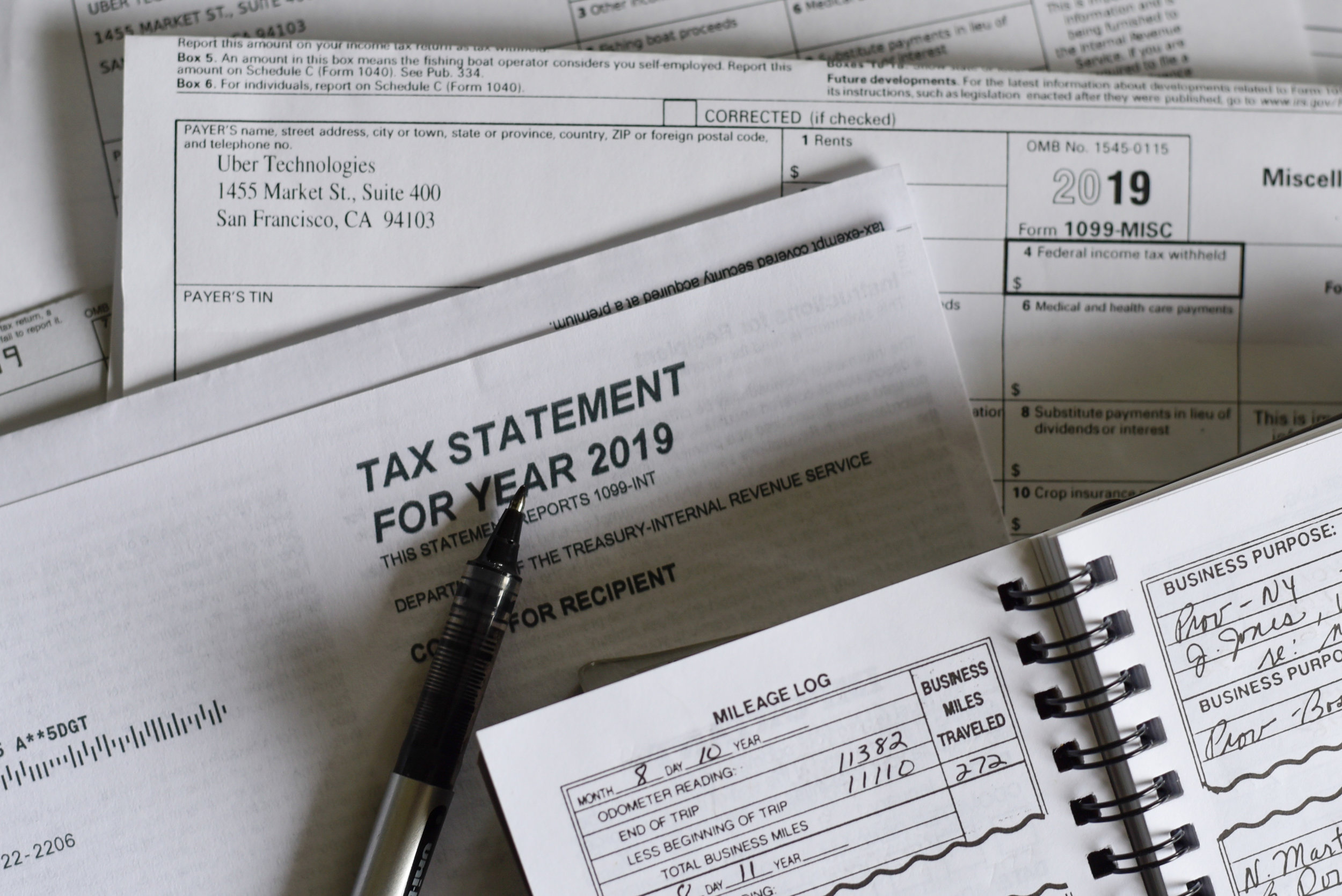

It’s important to understand how the wealthy prepare for taxes. You might not have a view into this, but I see it every day in my entertainment accounting practice, so I’ll give you the scoop. When I tell a small business client that they need to pay $500,000 in taxes, they always say, “Holy shit! Is there anything I can do to bring it down?” They are always more willing to purchase a new piece of equipment than to overpay in taxes. There are tons of legal tax planning options that we could choose from (deferment of gains, contributions to SEP IRAs, Section 79 life insurance, etc.), but none of them immediately stimulate the economy.

I’d like to also point out the obvious: if you are paying this much in taxes, you made a lot of money, which means you employ a team of professionals who will figure your taxes out for you. A solution is always designed, then executed. If that means moving to another state for more favorable state income tax rates, some people are ready, able and willing to do it. At the drop of a hat, a new house in a new state is purchased and life continues, undisturbed. There’s no reason — at least not a financial one — for a person in this position to stay if they could have a better quality of life in another state.

If you made a ton of money, you probably wouldn’t want to have to lose it all to federal and state taxes. That wouldn’t make you heartless. You don’t have an outsized duty to fund the country by way of taxes. It’s just stupid. You contribute in other ways by creating jobs, products, industry, communities and opportunities. And who’s left living in that expensive ass state when the wealthy pack up and leave? Everyone who didn’t have the means to hire that army of professionals or pick up and relocate. Just like that, that entire population of people who thought they were insulated from the effects of changes to the tax code are feeling it.

Money that isn’t paid in both federal and state taxes on the high earners will find its way to the middle class faster than the impact of tax-funded programs. Further, leaving people free to spend their own money means it moves in a more organic way that promotes free enterprise and protects capitalism. I’m the daughter of Cuban exiles, so you know that capitalism is my favorite word. It’s the reason for the season! Taxes on businesses and the wealthy in society should be reduced as a means to stimulate business investment in the short term and benefit all of society in the long term.

I’ll share a secret with you: rich people don’t just hoard money. None of my clients say “Oh! Let’s stash this in a regular savings account and let it sit there!” Never. They are rich for a reason. Money makes money, and I’ve never met a wealthy person who didn’t have money working for them while they sleep.

To illustrate this, I’ll give you a real-life scenario about a federal income tax savings. A few years ago, I estimated that a client’s taxes would be much higher than they actually were. No, I didn’t make a mistake (I get defensive!). The facts just changed. Anyway, while preparing this tax return, and after we applied the Qualified Business Income Credit (QBI), the tax due was about 20 percent less than I had budgeted. All year, I was this dark cloud looming over him saying, “It’s going to be a lot, doll. ¡Prepárate!” And then it turned out not to be so bad. What did he do? After breathing a sigh of relief, he went on to secure a mortgage for a two-family income rental property, financed a small boat that he started chartering to tourists, made a few charitable donations and got a full mouth of veneers.

A word on veneers: I’d like to note that people usually only veneer their front teeth because that’s all we see. A whole mouth of veneers is aggressive and gives the appearance of Chiclet teeth. But I’m not a dentist, so who am I to judge? In any case, the full mouth is about $40,000 and they were not tax deductible.

The point here is that economies were stimulated by tax savings resulting from the QBI. In this particular case: the housing market, the local government (via property taxes), boat manufacturers, docks collecting parking and storage revenue, gas & oil industries, and that dentist’s office! Jobs were created and the funds not overpaid in the form of income taxes got into the hands of that middle-class landscaper, real estate agent, the boat’s first & second mate, and the veneer technician who worked overtime on those chiclets.

Once you understand taxation as the forced distribution of wealth — whereas consumer and business spending is the elective, more natural, distribution of wealth — you’ll see these issues through new eyes!

“I’ll share a secret with you: rich people don’t just hoard money. None of my clients say “Oh! Let’s stash this in a regular savings account and let it sit there!” Never.”

I’d be remiss not to mention that taxation is necessary. Federal taxes fund defense, Social Security, Medicare, health programs, social programs, and national debt interest payments, to name a few things. State income taxes fund things like transportation, corrections, schools, Medicaid, housing and assistance to low income families. Don’t read this and picture me wearing a tricorne screaming “No taxation without representation!” Free markets first benefit those hustlers and hard workers who take advantage of every opportunity, but they don’t quickly address the financial situations of people who can’t help themselves. I’m not blind to the necessity of welfare programs, but I also think it’s very difficult for the social assistance cycle to be broken. Once you are a part of it, there are layers of incentives that keep you tethered to it, and that’s a problem that needs to be addressed.

Recognize how Biden’s tax plan (and tax plans like it) would affect you every day, and soon. Please read this slowly: government agencies are going to get their money by hook or by crook. If the rich pick up and move to states with lighter tax burdens like Texas, Nevada and Florida (because they can), how the hell are states like New York, New Jersey and California going to make up that tax revenue, especially following the spike in COVID-19 related unemployment claims? Keep in mind that unemployment is funded by employers who pay the state and federal taxes on wages paid to employees. Don’t think too hard; since you’ve read this far, I’ll just give you the answer. States can make up the difference in a myriad of ways that you and I would have to confront every minute of our lives: increased tolls, increased sales taxes, increased unemployment tax, increased property taxes on middle class neighborhoods, increased gas tax every time you fill up, and so on. Something as normal as jumping on the Garden State Parkway to go to Costco to buy milk, diapers and Bustelo could easily become a more expensive errand as governments look to make up for the revenue they lost when the wealthy were driven away.

Now that I’ve helped you picture what it would look like for a wealthy person to jump on their jet and move to Florida — and how that could never be you! — I want you to erase that image and replace it with some more realistic ones: A power washer who pays the bills servicing residential customers scores a grocery store chain contract. A local DJ goes from humble sweet sixteens and small weddings to a 7-day-a-week franchised operation. Both worked day and night, rain or shine, to reinvest every ounce of energy into their small businesses until they woke up one day and realized that they had achieved the American Dream. If you’re not careful, this could be you! It could be anyone, which is precisely why all tax rates need to be considered by all taxpayers. Before endorsing a tax plan that presents a combined federal/state tax rate of 62 percent of taxable income above $400,000, think to yourself, “What is this promoting?”

The sooner you understand that taxation is not just a rich person’s problem, the sooner you’ll reject these tax plans that are so gung-ho about exorbitant taxes on the rich. That creates conditions in which no one thrives. It takes a real stripping away of the aspirational parts of that American Dream mentality to decide that a combined federal and state tax rate of 62 percent will never affect you.

Margot R. Bordas is the owner and Tax Director of NuMiLa Inc., a boutique entertainment accounting firm with main clients in New York City, Miami, and L.A. She is Cuban-American and graduated with a Bachelor of Science and Masters in Professional Taxation from Seton Hall University and works exclusively with self-employed artists, producers, entertainers, athletes and influencers.